September 18th, 2025 Update

John Olaimey

President & CEO, Southern Bancorp Bank

Meet John Olaimey, President and CEO of Southern Bancorp Bank, who leads our banking operations with a strategic, mission-focused vision that is rooted in deep industry experience and a strong commitment to community impact.

John has more than two decades of leadership experience in banking, finance, corporate law, and executive management. At Southern Bancorp Bank, he oversees all banking activities, operations, and performance, including our Retail Banking, Lending, Credit and Loan Review, Mortgage, and SBA divisions.

Under John’s leadership, Southern Bancorp Bank is responsible for:

- Delivering our mission to our communities via lending and retail functions at all bank branches

- Managing credit and loan review processes, protocols, and policies, ensuring that each aligns with our goal to provide responsive and responsible lending to those who need it most

- Providing specialized and high-impact products and services tailored to the unique needs of our customers and communities

John and Darrin helping folks file their taxes for free at one of our VITA Super Saturday events

John celebrates the retirement of long-time SBCP financial counselor, Charlestien Harris

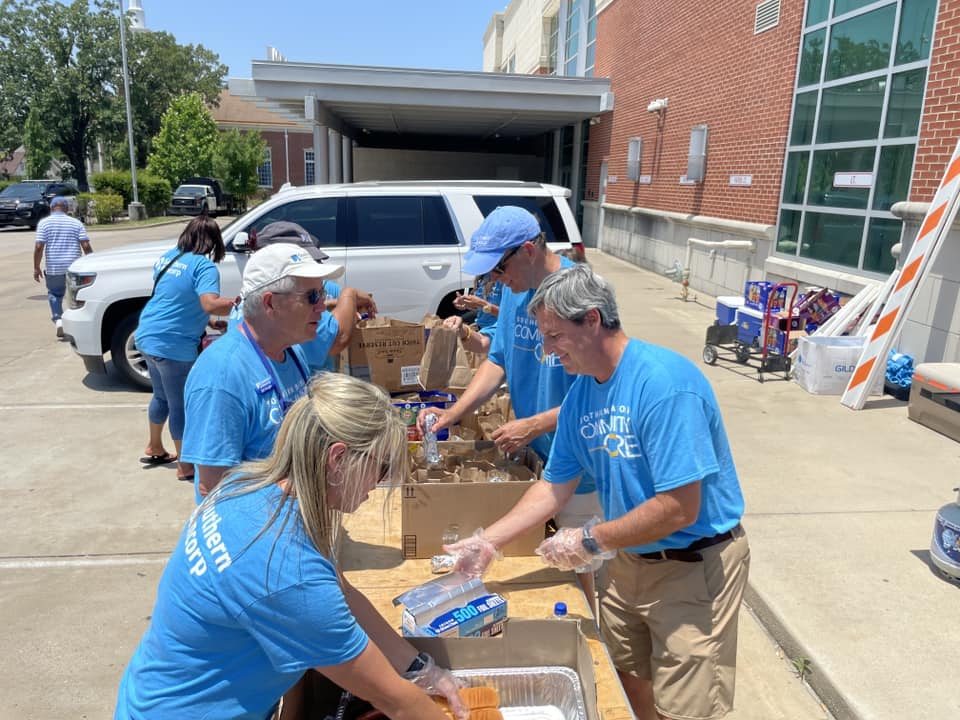

John and other Community Core volunteers serving food at a Little Rock community celebration

John surprising one of our 2025 RAISE Grand Prize Winners, Courtney McKinney (Trumann, AR)

Mission Minutes

Every two weeks, we’ll feature a message from a Southern staff member to you. These “Mission Minutes” are short and sweet videos providing you the opportunity to meet one of our Wealth Builders and hear directly from them why they work at Southern and what our mission means to them.

This week, enjoy hearing from Miguel Lopez, Market Strategy Executive – Hispanic/Latino Market at Southern Bancorp.

¡Disfruta de unos minutos escuchando a Miguel!

Impact in Action

Noe Moreno

Arkadelphia, AR

Noe Moreno is originally from Guerrero, Mexico, and has lived in Arkadelphia, AR, for 25 years. Seven years ago, he pulled a few dollars out of his pocket, purchased a $10 push mower at a yard sale, and took a leap of faith by pursuing his own landscaping business. For the first few years, he kept his day job and handled his entrepreneurship business on the side, but the dream was to eventually make the company his full-time occupation.

With the help of Southern Bancorp’s commercial lending team, Noe was able to make that dream a reality and greatly expand his lines of business.

With the support of accessible, flexible capital and a bank that believed in him, Noe has since turned his one-person lawn care business into a landscaping and dumpster rental service that not only supports him full-time, but is also now providing multiple jobs for his local community.

“Truth be told, I am now living the American Dream.” – Noe Moreno

September 4th, 2025 Update

Darrin Williams

CEO, Southern Bancorp, Inc.

Hello Legacy Team,

It’s been a minute since we last connected, and I’m thrilled to be kicking off a new way for us to stay in touch as we move forward together.

Starting this week, we’re launching bi-weekly updates on our new Southern + Legacy Welcome Site. This site is your go-to spot for updates, insights, and answers as we prepare for the exciting journey ahead.

Here’s what you can expect every other Thursday:

- Leadership Introductions – Meet Southern leaders and learn about their roles in the integration. This section will also feature a short Q&A segment – our first intro article will appear in our next update (Thursday, September 18th).

- Mission Minutes – Short videos from Southern team members sharing what it’s like working here and how they personally connect to our mission. We know video access can be tricky during the workday, so feel free to watch when it’s convenient for you.

- Impact in Action – Real stories from Southern customers that show our mission in motion.

In the coming weeks, we’ll be launching a new FAQs page – to include a growing list of frequently asked questions as well as a place for you to submit your own questions.

We’ll also be adding a section in the menu above titled CEO Blogs, which will include a collection of my monthly blogs to Southern staff that we publish in our employee newsletter and through which I share updates, inspiration, and impact with our team that I am honored to now share with you.

And don’t stress if you miss an update here and there. All updates will be archived on the page so you can catch up at any time.

So, what’s been happening this summer?

The short answer is…a lot! Since announcing the deal in June, we’ve been busy building bridges (and crossing several). In July, we hosted the Legacy leadership team for a visit across several of our markets — from Little Rock to the Mississippi Delta. It was more than a tour — it was a chance to connect, share stories, and see firsthand the communities we serve.

From meeting inspiring customers in Memphis, TN, and Clarksdale, MS, to walking through our branches and future sites, the visit confirmed what we’ve believed from the start: this is a strong match. Legacy’s commitment to serving rural and underserved communities aligns beautifully with Southern’s mission, and we’re excited to learn from each other as we grow together.

In August, I traveled to the Dallas/Fort Worth area with several Southern leaders, including SBB CEO John Olaimey; Head of Retail, Seun Aiyese; Chief Strategy Officer, Will Lambe; and our Hispanic Market Strategy Executive, Miguel Lopez. It was great meeting the teams in those branches, and I’m looking forward to visiting every branch in the coming weeks and months.

Also in August, we launched several integration workstreams — covering everything from operations and finance to HR and culture. These teams, made up of both Southern and Legacy staff, are working hard to ensure a smooth transition. While we expect the deal to close late this year or early 2026, a full integration will likely take all next year. That’s intentional. We want to do this right, with a strong focus on cultural alignment and long-term success.

Looking Ahead

As we head into Autumn, I’m filled with optimism about the future we’re building together. We’re committed to making this transition as smooth and meaningful as possible, and we’re thrilled to have you on this journey with us.

So keep an eye out for these updates every other Thursday. And if you’ve got questions, thoughts, or just want to say hello, we’d love to hear from you.

Here’s to a bright future that we’re building together!

Warmly,

Darrin Williams

CEO, Southern Bancorp

The Legacy team tours Southern's Little Rock 12th Street Branch

Visiting with our customer and former Clarksdale, MS, Mayor Chuck Espy

Touring the manufacturing facility at Red Panther Brewing in Clarksdale, MS

The Legacy team stopped for a photo at the famous Beale Street

Pictured left to right: SBB CEO John Olaimey, Legacy CEO John Everett, Legacy CFO Brandon Taylor, Legacy COO Jeremy Loftin, and SBB Market President Josh Newsom.

Mission Minutes

Every two weeks, we’ll feature a message from a Southern staff member to you. These “Mission Minutes” are short and sweet videos providing you the opportunity to meet one of our Wealth Builders and hear directly from them why they work at Southern and what our mission means to them.

Up first is Charles Blake, former Arkansas State Representative and current Little Rock Market Executive at Southern Bancorp.

Enjoy a minute (or two) with Charles (at the zoo)!

Impact in Action

Robby Hawkins

Lexa, AR

Robby Hawkins is a single dad of three boys aged 10, 12, and 14. Raising three boys is a job in itself, but on top of his full-time occupation as a truck driver, through which he often hits six states or more in the same week, Robby had his hands full. Amid this juggling act, the three-bedroom trailer they were living in was becoming dilapidated. “Life” was taking a toll, and Robby was in need of a break. He had a dream to purchase a home for his family that was also closer to his parents, who help with the boys while he’s on the road, but the savings foundation needed to unlock this opportunity was out of his reach.

That’s when he found out about Southern Bancorp’s Individual Development Account (IDA) program, which, through a funding partnership with the Arkansas Department of Human Services’ TANF program in 2023, offered income- and dependent-eligible Arkansans the ability to receive three times their savings for a qualified purchase. After participants saved $667 of their own money and completed financial literacy courses, the program matched them with an additional $2,000, for a total of $2,667 to purchase or make repairs to a home, open or grow a small business, or for education or vocational training.

While he was on the road on a big rig in New Mexico, Southern Bancorp’s nonprofit, lending, and IDA teams got Robby and his boys squared away with the application, approval process, IDA funding for his down payment, and an affordable home loan to seal the deal.

When all was said and done, Robby came out as a first-time homeowner and is living in a bigger and better space for his family’s needs, while simultaneously spending less money per month on his mortgage than he was for rent.